“Corporate governance is concerned with holding the balance between economic and social goals and between individual and communal goals. The governance framework is there to encourage the efficient use of resources and equally to require accountability for the stewardship of those resources. The aim is to align as nearly as possible the interests of individuals, corporations and society.” (Sir Adrian Cadbury, UK, Commission Report: Corporate Governance 1992)

Introduction

Corporate governance is the system of rules, practices, and processes by which an entity is directed and controlled. Corporate governance essentially involves balancing the interests of a company’s stakeholders, such as shareholders, senior management executives, customers, suppliers, financiers, the government, and the community. Since corporate governance also provides the framework for attaining a company’s objectives, it encompasses practically every sphere of management, from action plans and internal controls to performance measurement and corporate disclosure. Corporate governance includes the processes through which corporations’ objectives are set and pursued in the context of the social, regulatory and market environment. These include monitoring the actions, policies, practices, and decisions of corporations, their agents, and affected stakeholders. Corporate governance practices can be seen as attempts to align the interests of stakeholders.

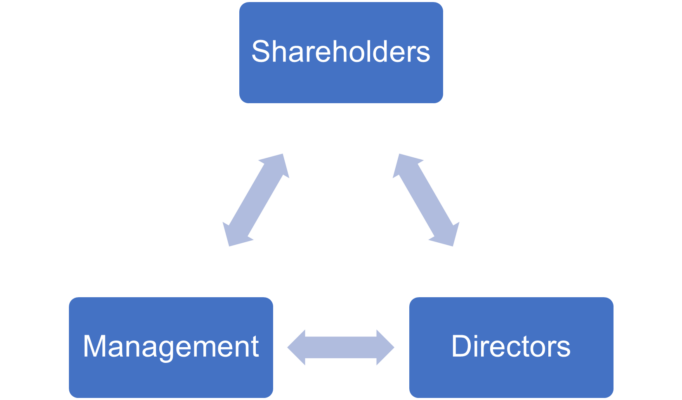

The responsibility of establishing and maintaining an effective and efficient corporate governance system falls on the board of directors of a company. This system of checks and balances aims to minimize conflicts of interest and ensure that shareholders are treated equally. However, this is a delicate balance of power that relies on three critical anchors. This triangular relationship consists of shareholders, management, and the board of directors. Each has its own responsibilities, but they need to work together for the system to be balanced and effective.

Conflict may arise between executives and shareholders – for instance, shareholders wanting to focus on profit while the chief executive officer may want to invest in bettering employee engagement. The role of corporate governance is to guide how these issues can be settled.

All three relationships in the governance triangle (shareholders–management, management–board of directors, and board of directors–shareholders) depend on mutual accountability and a free-flowing exchange of information.

There are few external stakeholders of the company namely, the vendors, creditors, customers, and the government, who also take a part in corporate governance systems of the company. One cannot ignore these stakeholders as they are extremely crucial for the company’s growth and sustainability.

There is however, a clear distinction between governance and management. Governance comes from the word “govern,” which means to control the actions of a group for the benefit of the whole. In the business world, this refers to policies that specifically restrict or direct how people can act. Management, on the other hand, refers to the actions taken by a company to lead the business in a positive direction.

Models of Corporate Governance

The corporate governance structure has certain basic elements. These elements are the composition of the board of directors, the regulatory framework, pattern of share ownership, key players in the corporate sector, interaction among the key players, disclosure requirements for listed companies, and corporate decisions that require approval of shareholders. These elements differ between different models prevalent in different countries. As a result there are different corporate governance models. These models are explained below:

Anglo-American Model

This model is also called an ‘Anglo-Saxon model’ and is used as basis of corporate governance in USA, UK, Canada, Australia, and some commonwealth countries. It is characterized by share ownership of individual and increasingly institutional investors not affiliated with the corporation (known as outside shareholders); a well-developed legal framework defining the rights and responsibilities of three key players as mentioned above, and a comparatively uncomplicated procedure for interaction between shareholder and corporation as well as among shareholders during or outside the annual general meeting. Here, the shareholder rights are recognized and given importance. This is a shareholder-oriented model. They have the right to elect all the members of the Board and the Board directs the management of the Company. The shareholders appoint directors who in turn appoint the managers to manage the business. The companies are run by professional managers who have negligible ownership stake. Thus, there is separation of ownership, management and control. Institution investors like banks and mutual funds are portfolio investors. When they are not satisfied with the company’s performance, they simply liquidate their holdings in the market. The disclosure norms are comprehensive and rules against the insider trading are tight. The small investors are protected and large investors are discouraged to take active role in corporate governance. The board usually consist of executive directors and few independent directors.

German Model

This model is also called the European Model. It is believed that workers are one of the key stakeholders in the company and they should have the right to participate in the management of the company. The corporate governance is carried out through two boards therefore, it is also known as a two-tier board model. The two boards are– the supervisory board and the management board. In the supervisory board, the shareholders elect the members of the supervisory board. Employees also elect their representatives for supervisory board which are generally one-third or half of the board. The management board is appointed and monitored by the supervisory board. The supervisory board has the right to dismiss the management board and re-constitute the same. The two boards are completely separate, and the size of the supervisory board is set by law and cannot be changed by the shareholders Also, in the German model, there are voting right restrictions on the shareholders. They can only vote a certain share percentage regardless of their share ownership.

Japanese Model

This model is also called as the business network model. Japanese companies raise significant part of capital through banking and other financial institutions. Here, the banking system is characterized by strong, long-term links between the banks and the corporations; a legal public policy and industrial policy framework designed to support and promote “keiretsu” (industrial groups linked by trading relationships as well as cross-shareholdings of debt and equity; boards of directors composed almost solely of insiders; and a comparatively low (in some corporations, non-existent) level of input of outside shareholders, caused and exacerbated by complicated procedures for exercising shareholders’ votes. Thus, the major shareholders are banks or financial institutions, apart from, large family shareholders, and corporates with cross-shareholding. Since the banks and other financial institutional stakes are very high in business, they also work closely with the management of the company. The shareholders and main banks together appoint the Board of Directors and the President. In this model, along with the shareholders, the interest of lenders is recognised. There is supervisory board which is made up of board of directors and a president, who are jointly appointed by shareholder and banks/financial institutions.

Indian Model

The model of corporate governances found in India is a hybrid system of the Anglo-American and German models. This is because, in India, there are three types of Corporations namely, private companies, public companies, and public sector undertakings (which includes statutory companies, government companies, banks, and other kinds of financial institutions. Each of these corporations has a distinct pattern of shareholding. In India, we have the shareholders who elect the board of directors, and the separate management, who looks after the day-to-day affairs of the company. The board of directors can consist of executive directors, non-executive directors, independent directors and non-independent directors. The non-executive directors, unlike the executive directors are not involved in daily management of the company. The independent directors act as a guide to the company. They are the watchdog and play a vital role in risk management by improving corporate credibility and governance standards. They also play an active role in various committees set up by the company to ensure good corporate governance. The nominee directors are appointed by the banks or financial institutions or the tribunals and courts for a specific purpose.

The Main Features of Corporate Governance Models

| Anglo-American | German | Japanese | Indian | |

| Oriented towards | Stock market | Banking market | Banking market | External Stakeholders |

| Shareholding structure | Dispersed | Concentrated | Concentrated (Cross Possession) | Dispersed |

| Management | Executive Directors, Non-Executive Directors | Supervisory Board, Management Board | Board of Directors, Revision Commission | Executive Directors, Non-Executive Directors, Independent Directors, Nominee Directors |

| Control System | External | Internal | Internal | Hybrid |

| Accounting System | GAAP | IFRS | GAAP & IFRS | AS & Ind-AS |

Strengths and Weaknesses of Corporate Governance Models

Not all corporate governance models are perfect; they cater to the business societies, regulations, traditions, cultures and practices prevalent in a country. Here are some of the strengths and weaknesses of the different corporate governance models practised around the world:

| Anglo-American | German | Japanese | Indian | |

| Strengths | Continuous Discipline | Multiple Risk Carriers | Decreased Optimism | Comprehensive Law |

| Transparency | Mutual Benefit | Owners’ Direct Influence | Disclosure | |

| Weakness | Failure | Slow-reaction | Change Resistance | Over-Regulation |

The company secretary needs to ensure that the entity infrastructure is appropriate for the organisation, that people are focused and work well together, resources are used effectively, and information flows smoothly. Decisions are then made effectively, and this all contributes to a successful and sustainable organisation. If the entity infrastructure is not appropriate for the organisation, then the anticipated ‘cultures’ will not be developed. Those within the organisation will develop their own cultures which, as they are not being managed, often leads to bad practices, such as failure to follow policies, the misuse of resources, breakdown of important relationships, etc. This in turn threatens the performance and long-term sustainability of the organisation.

Conclusion

It is said that good habits cannot be legislated – that is to say, no nation can pass a law to have a comprehensive legislation on good models, conduct on overall affairs of business. Corporate governance is a means to achieve the end. Based on the organisational purpose, the company secretary can advise the board on the appropriate corporate governance requirements for the organisation. The company secretary should ensure that the organisation puts in place the structures, policies and procedures required to meet the organisation’s specific strategic needs, manage its risks and comply with the appropriate laws, regulations, standards and codes applicable to the organisation. In doing so, the company secretary will need to consider the type of organisation and the sector within which it is operating as different laws, regulations, standards and codes will apply.

Bibliography

Models and Practices of Corporate Governance Worldwide by Mihaela Ungureanu

Models of Corporate Governance by The OECD

Corporate Governance Models: A Critical Assessment by Marco Mastrodascio

Does a Best Model Exist for Corporate Governance? by University of Pennsylvania