Introduction

With a view to increase transparency in reporting for Limited Liability Partnerships (“the LLPs”), the Ministry of Corporate Affairs (“the MCA”) introduced Rule 22A and Rule 22B in the Limited Liability Partnership Rules, 2009 (“LLP Rules”) on 27/10/2023 and introduced the Limited Liability Partnership (Significant Beneficial Owners), Rules, 2023 (“LLP SBO Rules”) on 09/11/2023.

Until now, only the companies were subjected to identify their Significant Beneficial Owners (“SBOs”) and follow the related compliances under Sections 89(10) and 90 of Companies Act, 2013 (“the Act”) read with Companies (Significant Beneficial Owners) Rules, 2018 (“Company SBO Rules”). The same have now been extended to the LLPs through the LLP SBO Rules.

The amendments are expected to align the framework of identification and reporting of SBOs of LLPs with that of companies. As a result, all the existing LLPs and the SBOs identified pursuant to the LLP SBO Rules would be required to take necessary steps and make requisite disclosure of such significant beneficial ownership.

We shall discuss the important aspects of these amendments with the intention, purpose and compliance requirements one by one.

Introduction of Beneficial Interest for LLPs

Obligation of the LLP

As per Rule 22A of the LLP Rules the law puts an obligation upon the LLPs to maintain a register of partners of the LLP in the prescribed manner. The register shall be maintained in Form 4A and the same is to be kept at the registered office of the LLP. The timeline to maintain such register is as follows:

| LLPs existing as on 27/10/2023 | LLPs formed post 27/10/2023 |

| Within 30 days from the commencement of Notification | Immediately after the incorporation of the LLP |

Any changes in the particulars of the partners shall be incorporated in the register within seven 7 days of such change.

Obligation of the Partners

As per Rule 22B(1) of the LLP Rules, every person whose name is entered in the register of partners but does not hold any beneficial interest in the contribution of the LLP (“the registered partner”), shall file a declaration in Form 4B to the LLP within 30 days of the name being entered in the register of partners of the LLP.

Rule 22B(2) of the LLP Rules, every person who holds or acquires a beneficial interest in the contribution of LLP, but their name has not been registered in the register of partners (“the beneficial partner”), shall file a declaration in Form 4C to the LLP within 30 days of acquiring such beneficial interest in the contribution of the LLP.

If there are any changes with respect to beneficial interest of the contribution of the LLP, both the registered partner and the beneficial partner shall file Form 4B and Form 4C respectively within 30 days of date of such change in beneficial interest in the contribution.

Obligation of the LLP

Pursuant to Rule 22B(3) on receipt of such declarations from the registered partner in Form 4B and the beneficial partner in Form 4C, the LLP shall file Form 4D to the concerned Registrar of Companies (“RoC”) within 30 days of the date of receipt of the declaration.

Summary of the forms under Rule 22A and Rule 22B of the LLP Rules

| Sl. No. | Provision | Form | Particulars |

| 1. | Rule 22A(1) & 22B(2) of LLP Rules | Form 4A | Maintenance of the register of partners as per the LLP Rules |

| 2. | Rule 22B(1) of LLP Rules | Form 4B | Declaration by the registered partner to the LLP |

| 3. | Rule 22B(2) of LLP Rules | Form 4C | Declaration by the beneficial partner to the LLP |

| 4. | Rule 22B(3) of LLP Rules | Form 4D | Filing of return of beneficial interest by the LLP to the ROC |

It is important to note that, Rule 22B of LLP Rules did not define or clarify the meaning of “beneficial interest” in the contribution of the LLP. The meaning of ‘beneficial interest in shares’ has been however clarified under Section 89(10) of the Act for the purpose of both Section 89 and Section 90 of the Act. Also, while Section 90 is applied to LLPs, Section 89(10) which defines as what the beneficial interest mean has not been applied to LLPs.

Nevertheless, under the LLP Act, a partner’s contribution in an LLP is permitted in any form, and the obligation for contribution, voting rights, and profit distribution rights linked to such contributions are regulated by the LLP agreement. This signifies that, in accordance with the LLP agreement, a beneficial partner may possess voting or profit distribution rights that may not precisely align with the recorded partner’s contribution. Consequently, defining the term ‘beneficial interest in contribution’ within the LLP context could have been helpful, offering clarity on the type of interest required for declaration under Rule 22B.

Top of Form

Significant Beneficial Ownership for LLPs

Significant Beneficial Owner in relation to a reporting LLP means an individual who acting alone or together or through one or more persons or trust, possesses one or more of the following rights or entitlements in such reporting LLP, namely:

- holds indirectly or together with any direct holdings not less than 10% of the contribution;

- holds indirectly or together with any direct holdings, not less than 10% of the voting rights in respect of the management or policy decisions in such LLP;

- has right to receive or participate in not less than 10% of the total distributable profits or any other distribution, in a financial year through indirect holdings alone or together with any direct holdings;

- has right to exercise or actually exercises significant influence or control, in any manner other than through direct-holdings alone.

Prerequisite of Holding Indirect Right or Entitlement in SBO

An individual is excluded from being recognized as an SBO if there is an absence of any indirect right or entitlement in the LLP. To qualify as a direct holder, the individual must either have the contribution registered in their own name or have formally declared the beneficial interest associated with the holding as per Rule 22B(2) of the LLP Rules read with Explanation I and Explanation II of Rule 3(1)(k) of the LLP SBO Rules.

Determination of SBO

In order to ascertain the SBO, an individual must initially meet the criteria set forth below.

| Sl. No. | Particulars | Criteria |

| 1. | Where the partner of the reporting LLP is a body corporate (whether incorporated or registered in India or abroad), other than an LLP and individual | An individual who –

a) holds majority stake in that partnership; or b) holds majority stake in the ultimate holding company (whether incorporated or registered in India or abroad) of that partnership. |

| 2. | Where the partner of the reporting LLP is a Hindu Undivided Family (HUF) (through karta) | An individual who is the karta of the HUF. |

| 3. | Where the partner of the reporting LLP is a partnership entity (through itself or a partner) | An individual who –

a) is a partner; or b) holds majority stake in the body corporate, which is a partner of the partnership entity; or c) holds majority stake in the ultimate holding company of the body corporate, which is a partner of the partnership entity. |

| 4. | Where the partner of the reporting LLP is a trust (through trustee) | An individual who –

a) is a trustee in case of a discretionary trust or a charitable trust; b) is a beneficiary in case of a specific trust; or c) is the author or settlor in case of a revocable trust. |

| 5. | Where the partner of the reporting LLP is a pooled investment vehicle or an entity controlled by the pooled investment vehicle, based in a member State of the Financial Action Task Force on Money Laundering, and the regulator of the securities market in such member State is a member of the International Organisation of Securities Commissions | An individual in relation to the pooled investment vehicle, who –

a) is a general partner; b) is an investment manager; or c) is a chief executive officer where the investment manager of such pooled vehicle is a body corporate or a partnership entity. |

| 6. | Where the partner of a reporting LLP is a pooled investment vehicle or an entity controlled by the pooled investment vehicle, based in a jurisdiction other than mentioned in clause (5) above | An individual who belongs to any of the clauses in (1) to (4) above. |

Meaning of Significant Influence

Significant influence means the power to participate, directly or indirectly, in the financial and operating policy decisions of the reporting LLP but does not mean control or joint control of those policies.

Meaning of Majority Stake

The majority stake shall mean:

- holding more than one-half of the equity share capital in the body corporate; or

- holding more than one-half of the contribution in a partnership entity; or

- holding more than one-half of the voting rights in the body corporate; or

- having the right to receive or participate in more than one-half of the distributable dividend or distributable profits or any other distribution by the body corporate including a partnership entity as the case may be;

Meaning of Control

Control includes the right to appoint majority of the designated partners or to control the management or policy decisions exercisable by a person or persons acting individually or in concert, directly or indirectly, including by virtue of their contribution or management rights or limited liability partnership agreements or other agreements or in any other manner;

Meaning of Ultimate Holding Company

Here, unlike SBO Rules, the concept of “ultimate holding company” has been defined in the LLP SBO Rules to mean any holding company as defined under Section 2(46) of the Act which is not a subsidiary of any other body corporate.

Obligations of the SBO

For initial disclosure, every individual who is an SBO for the existing reporting LLP as on 09/11/2023, shall furnish a declaration to the reporting LLP in Form LLP BEN-1 within 90 days from 09/11/2023, i.e., 07/02/2024.

For continual disclosure, an individual who subsequently becomes an SBO, or, where the significant beneficial ownership undergoes any change will be required to file the declaration in Form LLP BEN-1 to the reporting LLP within 30 days of acquiring such beneficial interest.

Changes in SBO during the transition period

In case an individual becomes an SBO or where his significant beneficial ownership undergoes any change, within 90 days of the commencement of this rules i.e., from 09/11/2023 to 07/02/2024, it shall be deemed that such individual became the SBO or any change therein happened on the date of expiry of 90 days from the date of commencement of this rules, and the period of 30 days for filing will be reckoned accordingly.

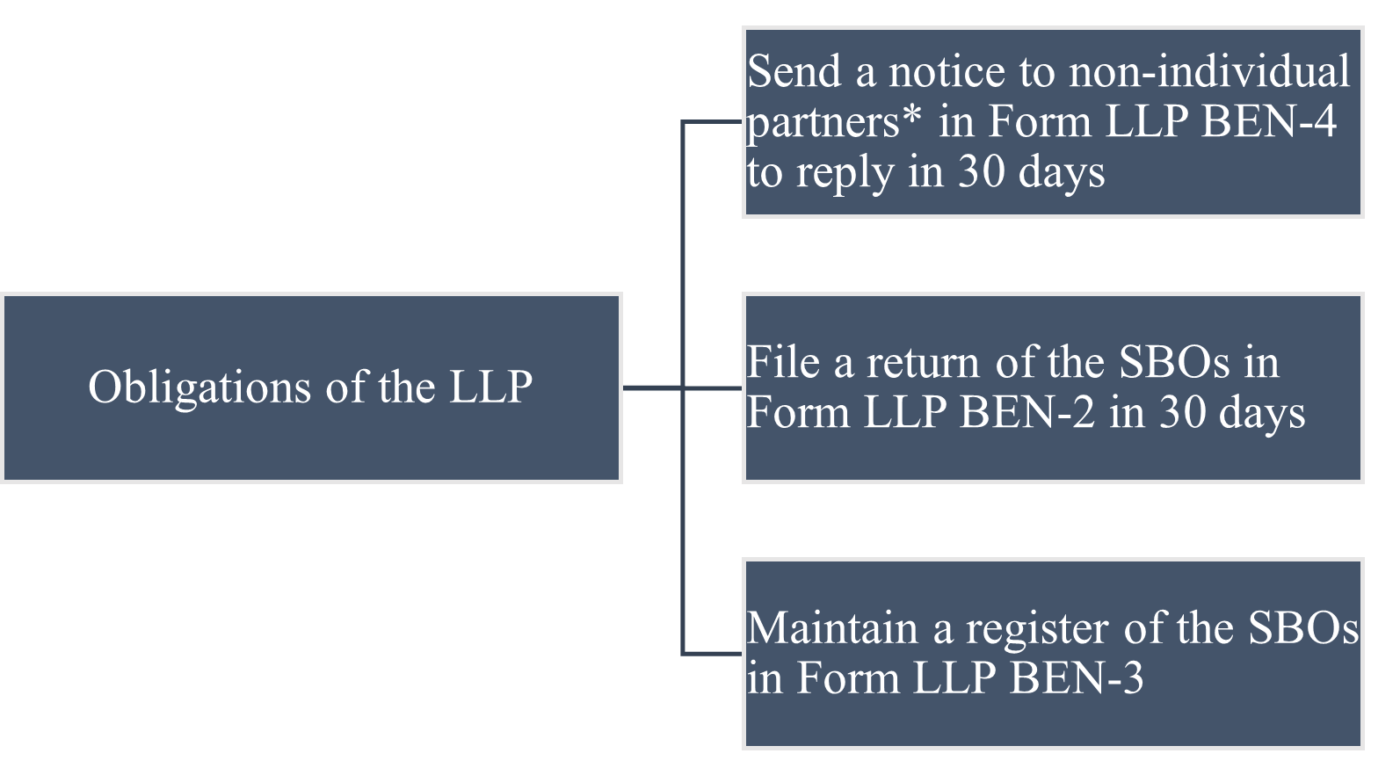

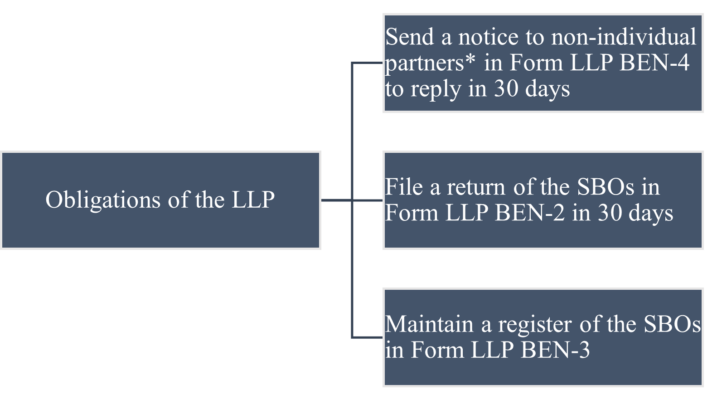

Obligations of the Reporting LLP

Such non-individual partner should be holding not less than 10% of its contribution or voting rights or right to receive or participate in the distributable profits in a financial year.

Exemption from the LLP SBO Rules

These rules will not be applicable to the extent the contribution of the reporting LLP is held by:

- the Central Government, State Government or any local authority;

- a reporting LLP or a body corporate or an entity, controlled by the Central Government or by one or more State Government, or partly by the Central Government and partly by one or more State Government;

- investment vehicles registered with, and regulated by the SEBI, such as mutual funds, AIFs, REITs, InVITs;

- an investment vehicle regulated by the Reserve Bank of India, or the Insurance Regulatory and Development Authority of India, or the Pension Fund Regulatory and Development Authority.

The exception granted to a subsidiary, allowing it to benefit from the SBO details submitted by the holding reporting company, does not apply to LLPs. Consequently, if one LLP holds ownership in another LLP, both entities are required to individually adhere to the regulatory norms without the extension of such an exemption.

Conclusion

The inclusion of LLPs in the regulatory framework for identifying and reporting SBOs, mirroring the obligations already imposed on companies, indicates the government’s commitment to enhancing transparency regarding the ultimate beneficial ownership of LLP structures. The introduction of the LLP SBO Rules has been praised for its potential to boost transparency in ownership, reinforce corporate governance, and instil trust in the business ecosystem. However, the true impact and effectiveness of these LLP SBO Rules will be evaluated over time as they are put into practice and their implications become more apparent.

Disclaimer: All the views in this article belong to the author, and all the interpretations are as on date of publishing of this article, which are subject to change based on clarifications provided by the MCA.